Whenever you read the financial section of the news, you’ll find at least one article that discusses recent rate hikes from the Bank of Canada. While there is cause for concern, in the grand scheme of things, the rates we have today are significantly lower than they were in the 1980s (which were well into the double digits).

Now, there are many reasons that caused the notoriously high-rates during that decade – too many to cover in this article. Instead we are going to review what happened in the ‘80s, how you can navigate these turbulent waters, and why (just like ‘80s Fashion) the ’80s-style economy isn’t coming back.

Are we in an ‘80s-style mortgage bubble?

Well that depends. The Canadian mortgage market is very different from region-to-region and from city-to-city. While Toronto and Vancouver have had rapid growth and the Bank of Canada raised their rates three times in 2018, not everyone is quick to say that we are in a bubble. The market is far more solid than it was in the 1980s: the economy is in better shape, interest rates are lower, and population growth and demand for housing are keeping pace with each other.

More Regulations Can Be a GOOD Thing

Okay, that was probably the most polarizing sentence in this article – but hear us out. The recession in the late 1970s and early 1980s resulted in high inflation, high interest rates, and high unemployment. In fact, in August 1981 the Bank of Canada rate hit 21.46% as it tried to curb the rising inflation rates on the Canadian economy. This is a far cry from the 3.95% rate to finish 2018.

After what happened to the economy and subsequently the housing market in the 1980s, the government increased regulations to ensure a more stable market should we return to a rocky economy.

More Regulations Can Be a BAD Thing

As more regulations are introduced, it makes it harder for those who are struggling to get approved for a loan of any type. Stress tests are now harder for your clients to pass, so that many potential homeowners have to lower their affordability – some experts are saying, they may have to lower their affordability by 10 – 15%.

4 Survival Tactics for an Increasing Rate Market

As it gets harder for Canadians to acquire mortgages, you need to get creative with how you can keep growing your business year-over-year. Below are 4 tactics you can use to boost your business in spite of increasing rates.

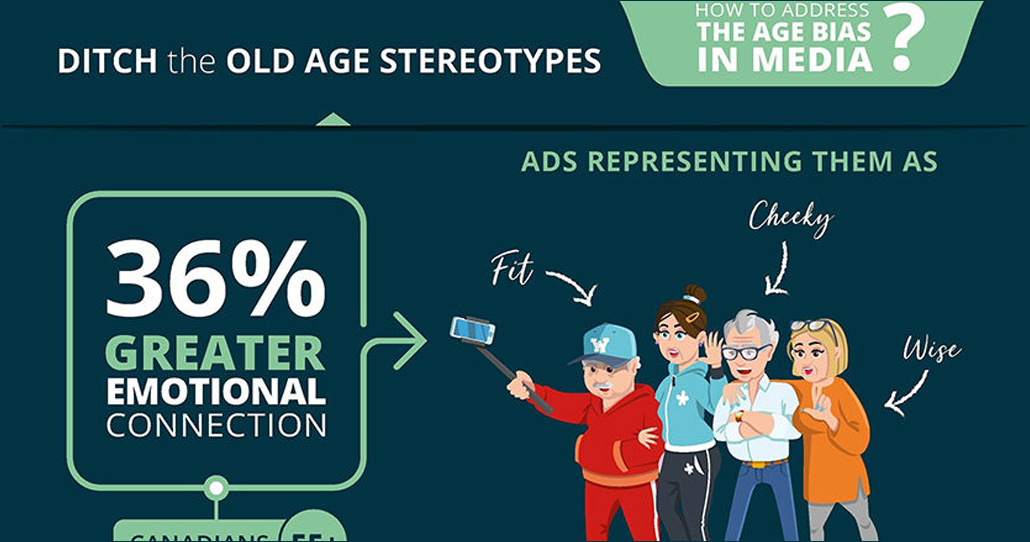

- Expand your audience base

Increasing rates has an impact on the number of clients seeking mortgages. However, young Canadians are not the only ones seeking mortgage solutions. In fact, a growing number of Canadians aged 55+ are seeking financial solutions that will help them live a comfortable retirement. - Embrace new technology

One thing mortgage brokers did to survive the turbulent ‘80s was to embrace new technology. This allowed them to serve their clients faster and more effectively, as well as made it easier to acquire new clients. Three pieces of technology you should embrace today are: a polished website, being active on social media, and email marketing.To learn more, read this article: 7 Marketing Tools & Tips When You Don’t Have a Marketing Team - Offer more products

The more variety of products you offer = the more potential clients you can have. Unlike the ‘80s, there are more products you can offer your clients. One example is reverse mortgages, they are a great product to offer to the growing cohort of Canadians aged 55+, who are looking to bridge the gap in their retirement savings. - Rising Household Debts + Increasing Rates = Opportunity

A good salesman knows, there’s a product to solve every problem. If your clients are feeling the pinch, there could be a way that you can help them navigate their financial situation. Take a moment every month to review your clientele and if there are any alternatives you offer that can help them.

SOURCES:

https://journals.sagepub.com/doi/pdf/10.1068/a260671?id=a260671

https://www.cbc.ca/news/canada/toronto/home-prices-real-estate-market-bubble-crash-1.4043803

https://www.huffingtonpost.ca/2016/04/25/toronto-real-estate-1988_n_9762348.html

https://globalnews.ca/news/3897942/new-mortgage-rules-2018-canada-guide/

https://globalnews.ca/news/4097215/canada-new-mortgage-rules-stress-test-2018/