How to help your clients help family members

It’s widely accepted that millennials are financially worse off than their parents, an assumption which is, unfortunately, borne out by the facts.

According to StatCan, despite earning an average of $90,047 at the median age of 31, which is 18.27% more than gen X at the same age, millennials are materially worse off. They pay on average 22.24% more tax than gen X at the same age and an eye-watering 31.91% more on housing. And that’s not all, millennials have on average $26,475 in savings, a good start but not nearly enough for the down payment on a home.

The bank of mom and dad

It’s not surprising, therefore, that older Canadians are helping out their adult children more than ever. According to a survey by RBC, an astounding 90% of parents provide financial support to their adult children, with expenses including education costs (69%), living expenses (65%), and cell phone bills (58%). According to a survey commissioned by FP Canada, contributing to the down payment on their child’s first home is also common, with 40% of parents doing or intending to do this.

Although most parents surveyed say they’re happy to help their adult children financially, 30% say they’re worried about the impact it could have on their retirement savings, and another 3 in 10 say they’re concerned they’ll have to delay retirement.

The CHIP Reverse Mortgage

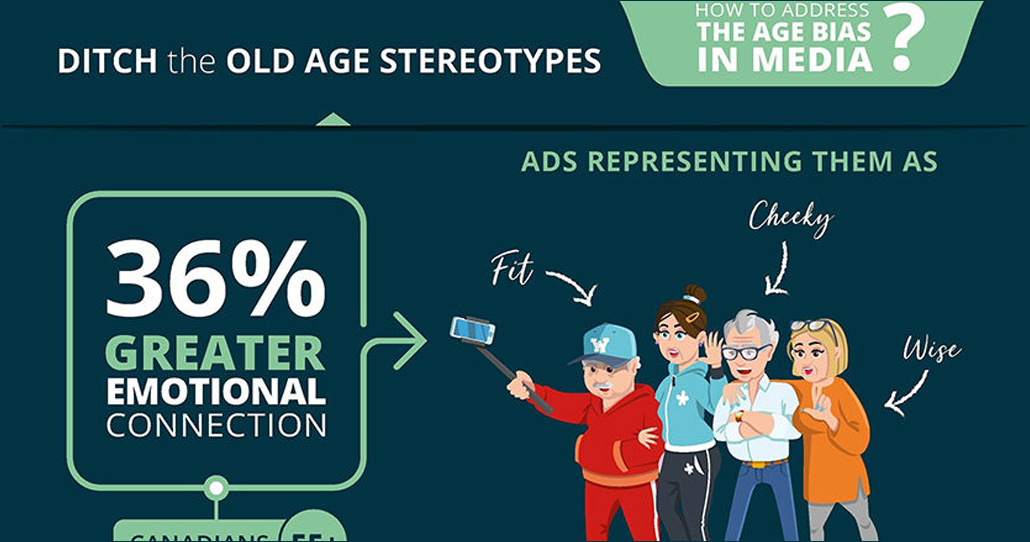

If your 55+ clients want to access cash to help their adult children or another family member without jeopardizing their retirement plans, the CHIP Reverse Mortgage can help.

The CHIP Reverse Mortgage allows your clients to access up to 55% of the value of their home in tax-free cash. Once they’ve paid off any other loans tied to the home, they can spend the money on whatever they want – whether that’s helping out a loved one or doing something for themselves, like making renovations or simply covering monthly outgoings. What’s more, since they don’t have to repay anything until they move out or pass away, there are no monthly repayments eating into their retirement income.

The CHIP Reverse Mortgage allows your clients to access cash without dipping into retirement investments and savings, so they can help their loved ones while maintaining their financial security. And since the cash received is tax-free, proceeds won’t affect your client’s marginal tax rate or trigger taxes or OAS/CPP clawback.

A concern that sometimes comes up surrounding reverse mortgages is whether there’ll be any equity left in the home when it’s time to sell. And the answer, the vast majority of the time, is yes.

The high cost of housing is the reason why many millennials still rely on their parents for financial support, however, by using the CHIP Reverse Mortgage, your clients will be able to turn Canada’s red-hot housing market to their children’s advantage.

To learn more, click here to speak to a BDM today.