CHIP Reverse Mortgage calculator

Discover how much home equity your client can access. Use our interactive calculator to customize a CHIP Reverse Mortgage solution that aligns with your client’s retirement financial goals.

Your client may be eligible for up to $111,500 in tax-free cash.

| Products |

CHIP Reverse Mortgage

|

CHIP Max

|

CHIP Open

|

Income Advantage

|

|||

|---|---|---|---|---|---|---|---|

| Details | Unlock home equity | Option for clients to access greater loan amounts | Access a short-term financing solution | Receive regular interval payments | |||

| Estimated Loan Amount* | |||||||

*Any future advances will be issued at the same interest rate term selected for the initial funding, but at the posted rate in effect at the time of the advance.

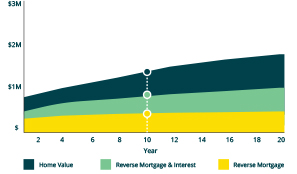

| Home Equity |

| Interest |

| Reverse Mortgage |

|

Today | In 5 Years |

|---|---|---|

| Home Value | $1,000,000 | $1,480,244 |

| Reverse Mortgage | $500,000 | $500,000 |

| Interest | $0 | $403,054 |

| Remaining Home Equity | $500,000 | $577,191 |

(Move slider left and right to review table variances.)

No Negative Equity Guarantee

Due to our No Negative Equity Guarantee, as long as the client meets their mortgage obligations, HomeEquity Bank guarantees

[1] that the amount they will have to pay on their due date will not exceed the fair market value of their home. If their home depreciates in value, or the mortgage

amount due is more than the gross proceeds from the sale of the property, HomeEquity Bank covers the difference between the sale price and the loan amount.

[1] Must maintain property, pay property taxes and homeowners’ insurance, and abide by your mortgage obligations. The guarantee excludes administrative expenses

and interest that has accumulated after the due date.

| Home Equity |

| Interest |

| Reverse Mortgage |

Expert Sales Support

Connect with our top-tier sales professionals dedicated to elevating your business with personalized reverse mortgage solutions

Get Started

Rate Sheet

DownloadFact Sheet

DownloadBrochure

DownloadFAQs

DownloadInterested in more resources?

Learn More

Retirement Strategies

Help Your Clients Unlock Spring Renovation Potential with the CHIP...

Retirement Strategies